We Serve All States of America

Alabama (AL)

Alaska (АК)

Arizona (AZ)

Arkansas (AR)

California (CA)

Colorado (CO)

Connecticut (CT)

Delaware (DE)

District of Columbia (DC)

Florida (FL)

Georgia (GA)

Hawaii (HA)

Idaho (ID)

Illinois (IL)

Indiana (IN)

Iowa (IA)

Kansas (KS)

Payday Loans Online as a Global Consumer Trend

Fast cash advances have grown into something bigger than just a fast financial relief. They have turned into the major global consumer trend with millions of borrowers across the world. According to the latest stats, borrowers from different countries spend a bit more than $7.4 billion a year! Customers turn to more than 20,000 lending opportunities available both at storefronts and online.

Clients opt for fast cash assistance for various reasons. It does not actually matter whether you need to cover running bills or meet unexpected cash emergencies. Payday loans online come as a fast financial relief without extra struggles if compared to conventional service provided by banks, credit unions, so forth. Cash advances have proved to be a quick solution to financial stumbling blocks without being a cash trap for consumers.

They have turned into an essential part of people’s daily lives with no need to cope with monthly repayment obligations. What lies behind this new financial trend? How will it change the way we handle our budgets? This article is to take readers behind the scene of financial services that are rapidly growing more and more popular.

What are Online Payday Loans?

Before we define the key aspects of cash advances, who generally applies to them, and why, we need to clarify the term. What are payday loans online? The financial service was initially introduced with the aim of helping people to cove different types of expenses from a single paycheck. The main idea was to make the loan terms as short as possible to oppose conventional crediting that usually turns into a bill trap for the borrower.

The key online payday loan features that differ it from brick-to-mortar banking services are as follows:

- Sum to borrow usually varies from $100 to $2500 (however, every company may establish its own loan amount, which obviously makes the service even more flexible);

- The repayment period usually does not exceed 2-3 weeks (the terms may vary from lender to lender as well);

- Customers may apply online. As a rule, a credit check is not required.

Those are the fundamental features that differ fast cash advance from conventional financial assistance. Now, let’s have a look who generally applies to payday loans online.

Who May benefit from Such Loans?

Well, everyone! As we have stated before, cash advances have grown into a new consumer trend. The latest stats show 12 million US-based grownups who annually opt for urgent cash assistance online. The average loan amount varies between $357 and $520. What does it mean?

It means that cash advances appear to be the fastest and easiest way to cope with unexpected budget troubles. Why should you ever go to a bank or credit union in case you only need a couple of hundreds considering the risk of being rejected? This is what makes online payday loans so special and popular with customers. The surveys say that 5.5% of all American adults have used the service within the last 5 years!

Another great benefit of fast cash advances is the fact they actually fit any buyer persona despite the gender or age (unless the applicant is under 18). From Millennials to Baby Boomers – online payday loans keep taking the audience by storm. The stats of currently owned cash advances are as follows:

- Baby Boomers – 81%;

- Millennials – 81.5%;

- Generation Z – 79.9%.

As you may see, the stats are pretty close. It means that urgent financial assistance might apply to any consumer category. We all need some cash from time to time. Could it really be so bad for people as some opponents say considering a growing amount of borrowers? Obviously not. The stats above prove that payday loans do work and help customers handle their budget obstacles.

The Online Payday Advance Process

The fast and simple application process is another fundamental reason why people would rather opt for direct lenders rather than state financial institution. We live in a world of bureaucracy and endless paperwork when it comes to different types of applications. For most consumers, visiting a bank is nothing but a waste of time. The situation is quite different with online cash advances. You are free to choose from a list of lenders and pick the one with the best terms and conditions. As a rule, the procedure requires taking several baseline steps.

Step 1 – Find a Lender

First of all, you need to find a company that meets your needs. Pay attention that each state has its own payday loan regulations when it comes to the loan amount, price, rates, etc. The best bet is to check with the official state and usage rate charts. The table has all states with the approved loan amounts, classifications, terms and other essential issues to consider.

Once you have identified the sum, you may borrow, you need to compare and contrast several firms and offers. Keep in mind that there are brokers and direct lenders. The difference is pretty clear. Direct lenders act on behalf of their own companies while brokers are intermediaries between the applicant and the lender. The best idea is to choose trusted firms. To do so, keep an eye on the following:

- Reputation on the web – look for previous reviews on other sites.

- Licensing – check for the company in the list of the officially licensed lenders.

- Contact info – a website should have a contact page with address, phone numbers, emails, etc.

Make sure a company meets all state and federal requirements.

Here is an example: you live in Alaska and urgently need some cash. You come across a company that offers $1,000 with a 30-day repayment period. If we look up at the Alaska loan regulations, we will see that the allowed loan amount must not exceed $500 with a 14-day repayment term. In other words, a lender does not meet state regulations, which means the firm is not legal.

Step 2 – Apply

A good thing about online services is the extended functionality and application freedom. You may apply on the go as well as from your office or home. The online procedure will take you a couple of minutes. To make the process even faster, make sure you have all necessary documents and copies to submit n case of necessity.

Meeting general requirements are obligatory. They vary from state to state although they are pretty basic:

- Age over 18.

- A steady job with monthly or weekly income that meets lender’s expectations.

- The official citizenship you may prove.

That is actually it. However, some companies may ask to provide additional information on your working experience, marital status, etc. Good news is that no credit check can’t be guaranteed. What does it mean for a borrower? It means that you may get necessary cash even with poor credit score!

Step 3 – Get Your Cash and Repay

After your application has been approved, you will have the cash transferred to your account. This is where working with direct lenders might be a better idea. They send you money directly while brokers are only intermediaries, which means more time to get your money.

The approval hardly takes more than 24 hours. Compare it to the conventional banking application procedure and you will instantly see the difference. Don’t forget to repay the loan and stick to the term and schedules determined by the agreement.

What can be daunting and consuming in that kind of procedure? This is what almost half of all borrowers think. 39% of all applicants use online services because they are much easier then applying for a loan elsewhere!

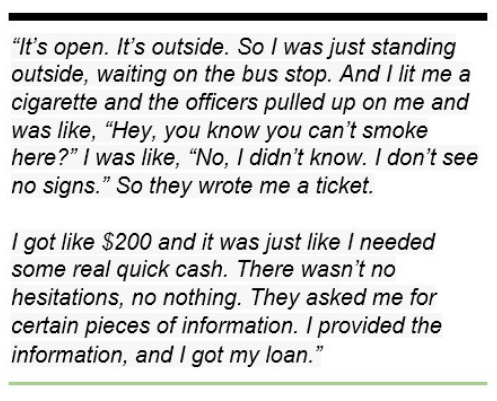

To prove the loan accessibility and ease, there is a story of a folk named Sebastian McKamey from Chicago. Once, he was ticketed for smoking near the bus stop. It was like a $150 fine who simply cud not afford while making only $8.45 per hour. The situation might get worth, as he did not have extra cash to repay. So Sebastian decided to opt for a payday loan. Here is the story from the horse’s mouth:

What are the reasons for taking out a payday loan online?

As it was stated earlier, ease of use and fast application process make at least 39% of all borrowers opt for payday loans instead of traditional crediting services. However, this is not the only reason that makes fast cash advanced a better option. Before we dive deep into the key benefits, let’s define the reasons why people tend to crave for extra cash.

We all may have some unexpected budget troubles and obstacles. At the same time, fast financial help is not only to deal with urgent situations. People tend to use them in order to cover their mundane living expenses that arise on the course of the month. The stats are as follows:

- 69% of borrowers use cash advanced to repay utilities, credit card bills, repairing costs, education, food or mortgage;

- Only 16% of customers use payday loans to cope with unexpected cash troubles.

The states show that cash advances are no longer a tool to struggle with cash problems. It has turned into a trusted nationwide financial service to oppose the time-consuming and out-of-date conventional crediting concept.

The Types of Loans Applied

As we mentioned at the beginning of the article, all types of buyer personas apply for payday loans despite the gender, occupation or age. They include the new wave Gen Z and older Gen X representatives that are the domination force in the consumer industry. The types of debts owed by them are as follows:

- Credit Cards – popular with all three major consumer categories including Baby Boomers (78%), Gen Z (70.2%), and Gen X (74.8%);

- Student Loans – more popular with Gen Z consumers estimating 58% of all borrowers;

- Unpaid Bills – the percentage of these debt types has reduced over the years estimating the average 30% of borrowers.

- Auto – about 35% of borrowers apply for fast cash advanced to have their cars repaired.

The rest of the debt types include medical, mortgage, personal and some other types of loans. In other words, we find ourselves in a situation where fast cash advances are no longer urgent help. They have turned into a trusted, easy-to-access, and trouble-free source of extra cash to oppose out-of-date and time-consuming conventional crediting concepts.

What Would People Do Without Payday Loans?

A special survey has been conducted to find out what people would do if there were no cash advanced offers. It appears that 81% of all borrowers would try to cut down on expenses while more than a half would probably be forced to postpone other bills repayment. Almost everyone would try to utilize some other offers including banks and credit unions. Here is the question: how would they apply when 53% of ALL borrowers opt for cash advances only because they were unable to get credit anywhere else according to Statist?

The problem is they would probably be rejected due to more and more unpaid bills that influenced their credit score. Most of them would have their backs against the wall in the end. SO, why should we borrow form family, relatives or friends? Why should we refuse to buy things we need like clothes or food? Online payday loans appear to be the best solution.

Direct Online Lenders

When you decide to access your fist loan, you will have to choose between a direct lender and broker. With so many offers online, there appear companies that act as intermediaries between firms and applicants. T define, which option is the right pick, let’s highlight the core features that apply to each party.

What is a Direct Lender?

A direct lender is an agency or firm that provides payday loans directly without opting for third-party services. It will work for those who do not want to pay extra fees and get their cash directly from the lender.

Good news is that all companies that provide any financial help are licensed and regulated by the state government. They follow all the necessary requirements and never overcharge rates and loan costs.

What Is a Broker?

A broker is a company that actually helps you to find the best-matching lender. It never handles the financial services itself. It is only a link between a customer and the agency. For applicants, it results in extra fees or commissions.

How to Identify a Broker?

Identifying a broker will hardly be a hassle. All you need is to keep an eye on details indicated in the broker’s site. They may include the following:

- The Official Statement – a trusted intermediary will always state that a firm acts as a broker but not a direct lender. If there is no such information, you might notice them speaking of “panel service providers”, which is also a sign of you dealing with a third-party agency.

- 100% Approval – licensed companies will never guarantee 100% approval, as there are plenty of factors to consider when evaluating borrower’s creditworthiness. If you see the sing “acceptance is guaranteed”, it means you are dealing with a broker.

- Extra Commissions – third-parties usually charge additional costs and commissions for their assistance. Direct lenders never charge upfront fees.

Direct vs Brokers

The choice depends on your expectations. As a rule, there are no problems with accessing direct lenders in terms of approval. The procedure is absolutely the same. So, is there any reason to overpay? It’s up to you to decide.

At the same time, we would like to show some obvious hits of working with direct lenders instead of opting for affiliates. While brokers will mainly take your info and push it through their lenders’ panels to find the best deal, they will also charge extra fees.

It is always great to remove any third party from your collaboration with the agency and get your cash directly from a service provider. As for the benefits a direct lender has, they are as follows:

- Zero accessing fees (you do not need to pay for the application process);

- Simple accessing procedure (you apply directly to a service provider);

- Zero upfront fees (no commissions or charges);

- Fast approval (it takes less time for direct lenders to review);

- Greater trustworthiness (it is always better to work with a licensed firm rather than the third party with little reputation);

- Get your cash right to the bank account.

As you may see, choosing direct service providers looks like a better idea especially if you do not want to overpay.

How do Payday Loans work?

To understand, how payday loans work, we need to clarify some fundamental issues in terms of regulations. For instance, three major types of states in the United States define the terms of providing financial services. They are divided into three major categories: permissive, hybrid, and restrictive states.

Permissive States

These states allow providing cash advance services and financial assistance. They establish fixed terms that regulate lenders’ activities. The initial fees are allowed around 15% and more from the sum, you want to get. For example, if you want to borrow $100, you will have to repay $120-$150 within two weeks in general.

Hybrid States

The states come with even more precise regulations or providing payday loans. The initial fees are lower if compared to the above mentioned category and start from 10%. However, a borrower has no right to exceed the number of loans borrowed at a time. A person will not be able to apply for more than 8 offers in a year.

Restrictive States

As a rule, there are price caps that tend to terminate the service itself. The state regulations either prohibit applying for cash advances or establish low PAR rates (about 36%) making it useless for companies to provide their services. Overall, there are 14 restrictive states in the USA mainly located in District Columbia.

So, each state defines the regulations while the baseline procedure is the same. A borrower is able to access a specific loan amount that varies from states to state. As a rule, it is somewhere between $200 and $1000. First of all, you need to apply and get approved to receive your cash. We have already discussed the major requirements a customer should meet.

Then you need to repay within a given period. It also varies depending on your location but usually is between 14-30 days. If you fail to pay on time, you may claim for loan extension or so-called rollover. It is the period when a borrower is not obliged to repay although the fees are still in process. In other words, all charges and costs keep accumulation.

Fast cash advances are never marked as “credit check loans”. It means that the agency does not care about your previous credit score or history. The approval procedure is different from conventional crediting where bans thoroughly check your payment track record.

Summing up, payday loans work much better and more effective even in the states where they are restricted by the government.

How do Online Payday Loans work?

The situation with online payday loans is even easier. According to the latest stats, 38% of all borrowers appreciate the ease of accessing cash advances online. The world keeps going mobile, which results in user-friendly and mobile-responsive websites letting customers apply on the go despite the location.

If you meet the baseline requirements, you only need to do the following to get your cash:

- 1. Choose a lender. As we have discussed earlier, it is always better to opt for direct service providers rather than work with third parties.

- 2. Check the pricing policy and terms. Do not apply in case you have not clarified the repayment period, fees, APR rates, and other possible fees or costs. Press the “submit” button only in case you are 100% sure everything is clear.

- 3. Fill in the personal info. This is where you are supposed to provide required data including your working details, salary, ID to prove your age and citizenship, etc. Get ready with some extra copies to submit upon lender’s request.

- 4. Send the applicator and wait for approval. As a rule, it takes about 24 hours to review your request. Do not trust companies that guarantee instant cash. As a rule, they only provide the lowest limit to get you engaged and opt for them later.

- 5. Get your cash. Once your application has been confirmed and approved, you will get your cash transferred to the bank account. Do not forget to indicate it during step 3.

- 6. Repay. The last but not the list is to get rid of your debt. Try to repay earlier if possible. If it, simply stick to your schedule to avoid fees and charges accumulating.

Apart from general goals payday loans serve, they might also be a greater tool whenever you need to repair your credit score. On the other hand, would really need to do that if considering extended accessibility of cash advances? We think you wouldn’t.

Are Online Payday Loans safe?

As you may judge from the paragraphs above, state authorities do their best to regulate financial services. They implement new tools to protect both borrowers and lenders. While customers may suffer from overprices rates, companies have to deal with unfair clients and frauds all the time. For this reason, the government takes part in the development of this niche and ensures it is 100% safe for both parties.

For Borrowers

Customers have plenty of ways to ensure they opt for a trusted firm. From reviews by previous borrowers and direct contacting to the official licensing that might be checked with just a couple of clicks.

For Companies

The government takes measures to protect agencies as well. In some states, customers are not allowed to apply for more than several loans per year ensuring their ability to repay and cover all the bills. On the other hand, agencies make everything possible to make the procedure as fast and simple as possible without any detriment to your safety. For example, websites use special means like SSL security and personal data encryption to stay away from hackers and frauds.

We may assume our readers that payday loans are 100% safe today.

Are Online Payday Loans legal?

They are legal in most of the states. Even restricted states allow providing financial services and cash advances in particular. A US-based citizen will never face difficulties in accessing a payday loan in case he or she meets all other requirements. Online application procedure made it easy to apply despite your location.

At the same time, we still recommend checking up with your state regulations to avoid any problem in future. You may find all available information in the official sources or even consult the potenti8al loan provider. Here is the chart of the legal payday loans status nationwide.

The Bottom Line

Payday loans online have turned into a new consumer trend. They are no longer a fast way to cope with emergencies. They have grown into trendy service to cope with current living expenses. Growing popularity proves the fact that fast cash advances are fast to get, easy to access, 100% safe and totally legal to use.

While traditional types of loans and banking services are growing out-of-date or mainly refer to corporate customers, instant online financial services represent the new gen cash assistance that refers to the modern world we live in. While leading industry names are making their services more flexible and functional, we might expect some crucial improvements in the niche of urgent financial assistance. On the other hand, a loan requires repayment. So, you need to be absolutely sure you really need that money with the ability to repay. If so, grab your chance to cash now!

We want to help you to have enough cash!

How can we help?

some reasons of why do you have to choose us

- Have you ever experienced financial problems? If not, then you are a lucky man. Everyone who has faced financial constraints knows that there is no better way to solve them than to ask for a payday loan. And that's exactly what Payday-Loans-Cash-Advance.net offers to you: the most reputable payday lenders for a fruitful cooperation.

- Short-term cash problems can overtake you at any time, giving up is not an option. We have a lot of lenders in our network, so one of them will most likely fit you. When an unexpected bill comes, you have no time to think – you just have to pay for it. With the help of Payday-Loans-Cash-Advance.net you’ll cover emergency expenses and reanimate your business.

- What is even better, we’re totally free. No fees for the service. Just save your money and time. All you have to do is to give us the relevant information, and for the shortest possible time we’ll provide you with loan options that meet specified conditions.

- We’re working only with fair and honest lenders. No deception, cheating, or manipulation. All lenders follow the rules related to payday lending. We guarantee you a clean deal.

- You’re still browsing to find a site with fair loan options? Forget about it. As well as about driving around a city to suddenly discover an acceptable payday loan shop. Payday-Loans-Cash-Advance.net is the right place to take a payday loan. As a rule, our vast network provides you with a suitable option immediately. No delays and hassles!

FAQ

Toggle content (click to open)

It is your opportunity to quickly and seamlessly deal with unforeseen financial problems. Our network lenders provide you with cash up to $1000, so you can always make ends meet.

You can read more about PayDay Loans from Wikipedia

It’s not a big deal to take a loan in our network. You just need to meet the following requirements:

• 18+ years old.

• No job change for the past month.

• Wage of at least $800.

• Valid e-mail, home address and phone number.

Some information you can check from Oficial CFPB site

You cannot get more than $1,000. The loan amount is different in each individual case: it depends on the info provided.

All that you need to get money is to have an account in bank. The money is deposited there.

Yes, you can get a loan even if you have credit problems, such as judgments or bankruptcy. We believe that setbacks are temporary, so we’ll provide you with a payday loan.

In most cases our clients apply for a loan in 5 minutes, or even faster. It is really an instantaneous procedure to apply for a loan through Payday-Loans-Cash-Advance.net. You’ll get access to relevant lenders that meet your needs in the most accurate form. Typically, a client can obtain a loan no later than in 24 hours.

Yes, it would be nice to get a fax machine, as the lender may need some additional financial info. However, this condition is not necessary: you can use postal store or local library.

The repaying cost is predetermined by lender on a number of conditions, such as terms and rates. Being approved for a loan, before e-signing anything you familiarize with detailed conditions that fully disclose the exact cost.

You can take two loans simultaneously from one lender. But be sure to apply for another payday loan only after disclosing to the lender the paying off of a previous one.

Most often, the money is automatically deducted from your bank account. This is convenient for both you and the lender. If you are experiencing problems with the transfer of money, immediately contact the lender to resolve the situation.

We cannot give you a concrete answer to this question, because each individual lender regulates the conditions in his own way. We recommend you to carefully examine the terms of the deal before signing.

Your personal data is strictly confidential and completely safe. All information is stored in encrypted form, with the use of the most progressive and reliable software.

You can apply for a loan not earlier than 72 hours after the previous attempt. When re-enrolling, be sure to notify the lender that you are already on a loan.

Each state regulates this issue in its own way. If you live in a state, where legislation allows extension of credit return, contact your lender with the correspondent request.

- 3

- 2

- 9

- 7

- 5